Condo Insurance in and around Yorkville

Unlock great condo insurance in Yorkville

Quality coverage for your condo and belongings inside

Your Personal Property Needs Insurance—and So Does Your Condo.

Committing to condo ownership is an exciting decision. You need to consider location home layout and more. But once you find the perfect townhome to call home, you also need terrific insurance. Finding the right coverage can help your Yorkville unit be a sweet place to call home!

Unlock great condo insurance in Yorkville

Quality coverage for your condo and belongings inside

Protect Your Condo With Insurance From State Farm

Things do happen. Whether damage from weight of sleet, vandalism, or other causes, State Farm has excellent options to help you protect your condominium and personal property inside against unexpected circumstances. Agent Aaron Hergenhahn would love to help you provide you with coverage that is personalized to your needs.

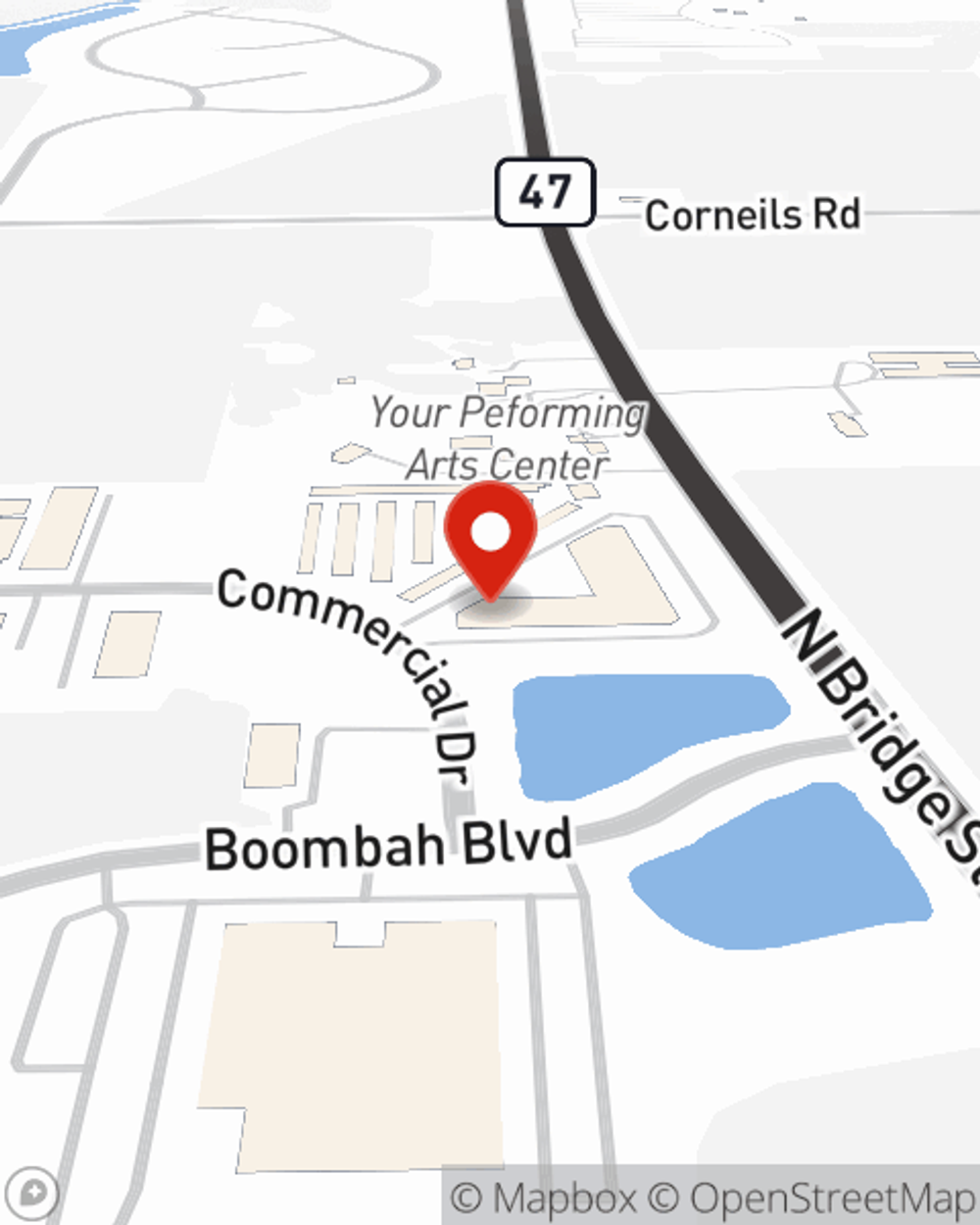

Finding the right coverage for your unit is made easy with State Farm. There is no better time than today to visit agent Aaron Hergenhahn and explore more about your outstanding options.

Have More Questions About Condo Unitowners Insurance?

Call Aaron at (630) 553-0005 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.

Aaron Hergenhahn

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.